8 SUBCONSCIOUS MISTAKES OUR BRAINS MAKE EVERY DAY—AND HOW TO AVOID THEM

THE “SWIMMER’S BODY ILLUSION," AND OTHER WAYS OUR BRAINS PLAY TRICKS ON US.

Editor's Note: This is one of the most-read leadership articles of 2013. Click here to see the full list.

Get ready to have your mind blown.

I was seriously shocked at some of these mistakes in thinking that I subconsciously make all the time. Obviously, none of them are huge, life-threatening mistakes, but they are really surprising and avoiding them could help us make more rational, sensible decisions.

Especially since we strive for self-improvement at Buffer, if we look at our values, being aware of the mistakes we naturally have in our thinking can make a big difference in avoiding them. Unfortunately, most of these occur subconsciously, so it will also take time and effort to avoid them--if you want to.

Regardless, I think it’s fascinating to learn more about how we think and make decisions every day, so let’s take a look at some of these habits of thinking that we didn’t know we had.

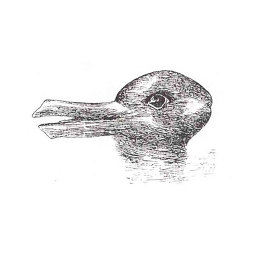

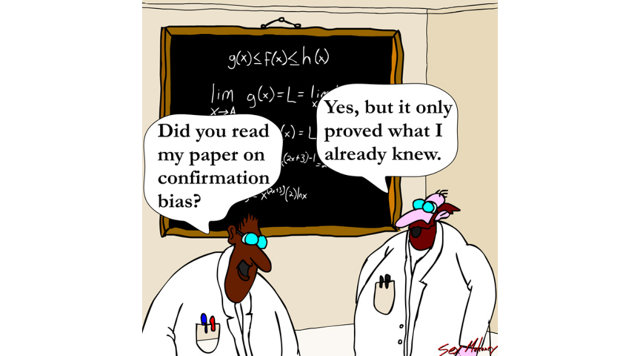

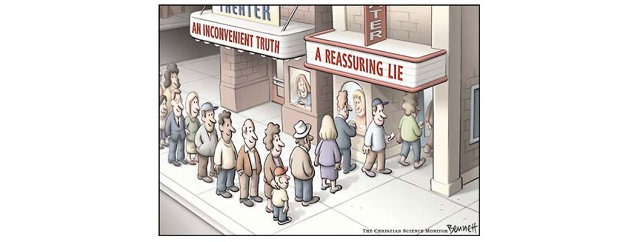

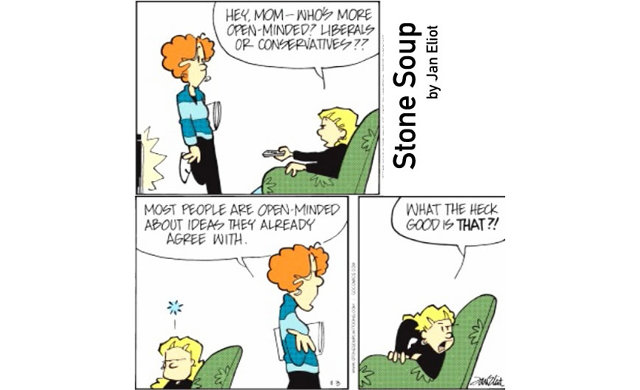

1. We surround ourselves with information that matches our beliefs.

We tend to like people who think like us. If we agree with someone’s beliefs, we’re more likely to be friends with them. While this makes sense, it means that we subconsciously begin to ignore or dismiss anything that threatens our world views, since we surround ourselves with people and information that confirm what we already think.

This is called confirmation bias. If you’ve ever heard of the frequency illusion, this is very similar. The frequency illusion occurs when you buy a new car, and suddenly you see the same car everywhere. Or when a pregnant woman suddenly notices other pregnant women all over the place. It’s a passive experience, where our brains seek out information that’s related to us, but we believe there’s been an actual increase in the frequency of those occurrences.

It’s similar to how improving our body language can also actually change who we are as people.

Confirmation bias is a more active form of the same experience. It happens when we proactively seek out information that confirms our existing beliefs.

Not only do we do this with the information we take in, but we approach our memories this way, as well. In an experiment in 1979 at the University of Minnesota, participants read a story about a women called Jane who acted extroverted in some situations and introverted in others. When the participants returned a few days later, they were divided into two groups. One group was asked if Jane would be suited to a job as a librarian, the other group was asked about her having a job as a real-estate agent. The librarian group remembered Jane as being introverted and later said that she would not be suited to a real-estate job. The real-estate group did exactly the opposite: They remembered Jane as extroverted, said she would be suited to a real-estate job, and when they were later asked if she would make a good librarian, they said no.

In 2009, a study at Ohio State University showed that we will spend 36% more time reading an essay if it aligns with our opinions.

Whenever your opinions or beliefs are so intertwined with your self-image that you couldn’t pull them away without damaging your core concepts of self, you avoid situations that may cause harm to those beliefs. --David McRaney

This video teaser for David McRaney’s book, You are Now Less Dumb, explains this concept really well with a story about how people used to think geese grew on trees (seriously), and how challenging our beliefs on a regular basis is the only way to avoid getting caught up in the confirmation bias:

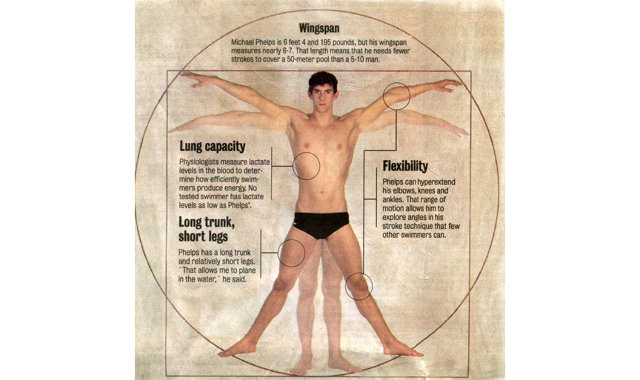

2. We believe in the “swimmer’s body” illusion.

This has to be one of my favorite thinking mistakes. In Rolf Dobelli’s book, The Art of Thinking Clearly, he explains how our ideas about talent and extensive training are well off-track:

Professional swimmers don’t have perfect bodies because they train extensively. Rather, they are good swimmers because of their physiques. How their bodies are designed is a factor for selection and not the result of their activities.

The “swimmer’s body illusion” occurs when we confuse selection factors with results. Another good example is top-performing universities: Are they actually the best schools, or do they choose the best students, who do well regardless of the school’s influence? Our mind often plays tricks on us, and that is one of the key ones to be aware of.

What really jumped out at me when researching this section was this particular line from Dobelli’s book:

Without this illusion, half of advertising campaigns would not work.

It makes perfect sense, when you think about it. If we believed that we were predisposed to be good at certain things (or not), we wouldn’t buy into ad campaigns that promised to improve our skills in areas where it’s unlikely we’ll ever excel.

This is similar to the skill of learning to say no, or how our creativity actually works: Both diverge strongly from what we think is true, versus what actions will actually help us get the result we want.

3. We worry about things we’ve already lost.

No matter how much I pay attention to the sunk-cost fallacy, I still naturally gravitate towards it.

The term sunk cost refers to any cost (not just monetary, but also time and effort) that has been paid already and cannot be recovered. So it's a payment of time or money that’s gone forever, basically.

The reason we can’t ignore the cost, even though it’s already been paid, is that we wired to feel loss far more strongly than gain. Psychologist Daniel Kahneman explains this in his book, Thinking Fast and Slow:

Organisms that placed more urgency on avoiding threats than they did on maximizing opportunities were more likely to pass on their genes. So over time, the prospect of losses has become a more powerful motivator on your behavior than the promise of gains.

The sunk-cost fallacy plays on our tendency to emphasize loss over gain. This research study is a great example of how it works:

Hal Arkes and Catehrine Blumer created an experiment in 1985 that demonstrated your tendency to go fuzzy when sunk costs come along. They asked subjects to assume they had spent $100 on a ticket for a ski trip in Michigan, but soon after found a better ski trip in Wisconsin for $50 and bought a ticket for this trip, too. They then asked the people in the study to imagine they learned the two trips overlapped and the tickets couldn’t be refunded or resold. Which one do you think they chose, the $100 good vacation, or the $50 great one?More than half of the people in the study went with the more expensive trip.It may not have promised to be as fun, but the loss seemed greater.

So like the other mistakes I’ve explained in this post, the sunk-cost fallacy leads us to miss or ignore the logical facts presented to us and instead make irrational decisionsbased on our emotions--without even realizing we’re doing so:

The fallacy prevents you from realizing the best choice is to do whatever promises the better experience in the future, not which one negates the feeling of loss in the past.

Being such a subconscious reaction, it’s hard to avoid this one. Our best bet is to try to separate the current facts we have from anything that happened in the past. For instance, if you buy a movie ticket only to realize the movie is terrible, you could either:

A) stay and watch the movie, to “get your money’s worth” since you’ve already paid for the ticket (sunk-cost fallacy)

or

B) leave the cinema and use that time to do something you’ll actually enjoy.

The thing to remember is this: You can’t get that investment back. It’s gone. Don’t let it cloud your judgment in whatever decision you’re making in this moment--let it remain in the past.

4. We incorrectly predict odds.

Imagine you’re playing Heads or Tails with a friend. You flip a coin, over and over, each time guessing whether it will turn up heads or tails. You have a 50-50 chance of being right each time.

Now, suppose you’ve flipped the coin five times already and it’s turned up heads every time. Surely, surely, the next one will be tails, right? The chances of it being tails must be higher now, right?

Well, no. The chances of tails turning up are 50-50. Every time. Even if you turned up heads the last 20 times. The odds don’t change.

The gambler’s fallacy is a glitch in our thinking--once again, we’re proven to be illogical creatures. The problem occurs when we place too much weight on past events and confuse our memory with how the world actually works, believing that they will have an effect on future outcomes (or, in the case of Heads or Tails, any weight, since past events make absolutely no difference to the odds).

Unfortunately, gambling addictions in particular are also affected by a similar mistakes in thinking--the positive expectation bias. This is when we mistakenly think that eventually our luck has to change for the better. Somehow, we find it impossible to accept bad results and give up--we often insist on keeping at it until we get positive results, regardless of what the odds of that actually happening are.

5. We rationalize purchases we don’t want.

I’m as guilty of this as anyone. How many times have you gotten home after a shopping trip only to be less than satisfied with your purchase decisions and started rationalizing them to yourself? Maybe you didn’t really want it after all, or in hindsight you thought it was too expensive. Or maybe it didn’t do what you hoped and was actually useless to you.

Regardless, we’re pretty good at convincing ourselves that those flashy, useless, badly thought-out purchases are necessary after all. This is known as post-purchase rationalization or Buyer’s Stockholm Syndrome.

The reason we’re so good at this comes back to psychology of language:

Social psychologists say it stems from the principle of commitment, our psychological desire to stay consistent and avoid a state of cognitive dissonance.

Cognitive dissonance is the discomfort we get when we’re trying to hold onto two competing ideas or theories. For instance, if we think of ourselves as being nice to strangers, but then we see someone fall over and don’t stop to help them, we would then have conflicting views about ourselves: We are nice to strangers, but we weren’t nice to the stranger who fell over. This creates so much discomfort that we have to change our thinking to match our actions--in other words, we start thinking of ourselves as someone who is not nice to strangers, since that’s what our actions proved.

So in the case of our impulse shopping trip, we would need to rationalize the purchases until we truly believe we needed to buy those things so that our thoughts about ourselves line up with our actions (making the purchases).

The tricky thing in avoiding this mistake is that we generally act before we think (which can be one of the most important elements that successful people have as traits!), leaving us to rationalize our actions afterwards.

Being aware of this mistake can help us avoid it by predicting it before taking action--for instance, as we’re considering a purchase, we often know that we will have to rationalize it to ourselves later. If we can recognize this, perhaps we can avoid it. It’s not an easy one to tackle though!

6. We make decisions based on the anchoring effect.

Dan Ariely is a behavioral economist who gave one of my favorite TED talks ever about the irrationality of the human brain when it comes to making decisions.

He illustrates this particular mistake in our thinking superbly, with multiple examples. The anchoring effect essentially works like this: rather than making a decision based on pure value for investment (time, money, and the like), we factor in comparative value--that is, how much value an option offers when compared to another option.

Let’s look at some examples from Dan, to illustrate this effect in practice:

One example is an experiment that Dan conducted using two kinds of chocolates for sale in a booth: Hershey’s Kisses and Lindt Truffles. The Kisses were one penny each, while the Truffles were 15 cents each. Considering the quality differences between the two kinds of chocolates and the normal prices of both items, the Truffles were a great deal, and the majority of visitors to the booth chose the Truffles.

For the next stage of his experiment, Dan offered the same two choices, but lowered the prices by one cent each. So now the Kisses were free, and the Truffles cost 14 cents each. Of course, the Truffles were even more of a bargain now, but since the Kisses were free, most people chose those, instead.

Your loss-aversion system is always vigilant, waiting on standby to keep you from giving up more than you can afford to spare, so you calculate the balance between cost and reward whenever possible. -You Are Not So Smart

Another example Dan offers in his TED talk is when consumers are given holiday options to choose between. When given a choice of a trip to Rome, all expenses paid, or a similar trip to Paris, the decision is quite hard. Each city comes with its own food, culture, and travel experiences that the consumer must choose between.

When a third option is added, however, such as the same Rome trip, but without coffee included in the morning, things change. When the consumer sees that they have to pay 2,50 euros for coffee in the third trip option, not only does the original Rome trip suddenly seem superior out of these two, it also seems superior to the Paris trip. Even though they probably hadn’t even considered whether coffee was included or not before the third option was added.

Here’s an even better example from another of Dan’s experiments:

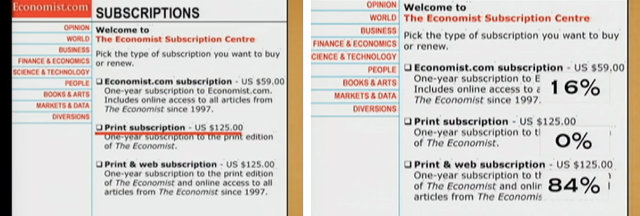

Dan found this real ad for subscriptions to The Economist and used it to see how a seemingly useless choice (like Rome without coffee) affects our decisions.

To begin with, there were three choices: subscribe to The Economist web version for $59, the print version for $125, or subscribe to both the print and web versions for $125. It’s pretty clear what the useless option is here. When Dan gave this form to 100MIT students and asked them which option they would choose, 84% chose the combo deal for $125. 16% chose the cheaper web-only option, and nobody chose the print-only option for $125.

Next, Dan removed the ‘useless’ print-only option that nobody wanted and tried the experiment with another group of 100 MIT students. This time, the majority chose the cheaper, web-only version, and the minority chose the combo deal. So even though nobody wanted the bad-value $125 print-only option, it wasn’t actually useless--in fact, it actually informed the decisions people made between the two other options by making the combo deal seem more valuable in relation.

This mistake is called the anchoring effect, because we tend to focus on a particular value and compare it to our other options, seeing the difference between values rather than the value of each option itself.

Eliminating the "useless" options ourselves as we make decisions can help us choose more wisely. On the other hand, Dan says, a big part of the problem comes from simply not knowing our own preferences very well, so perhaps that’s the area we should focus on more, instead.

While we know that our decision-making skills as people are often poor, (more on this topic here), it’s fascinating how the term free can affect us. In fact free has been mentioned before as one of the most powerful ways that can affect our decision making.

7. We believe our memories more than facts.

Our memories are highly fallible and plastic. And yet, we tend to subconsciously favor them over objective facts. The availability heuristic is a good example of this. It works like this:

Suppose you read a page of text and then you’re asked whether the page includes more words that end in “ing” or more words with “n” as the second-last letter. Obviously, it would be impossible for there to be more “ing” words than words with “n” as their penultimate letter (it took me a while to get that--read over the sentence again, carefully, if you’re not sure why that is). However, words ending in “ing” are easier to recall than words like hand, end, or and, which have “n” as their second-last letter, so we would naturally answer that there are more “ing” words.

What’s happening here is that we are basing our answer of probability (that is, whether it’s probable that there are more “ing” words on the page) on how available relevant examples are (for instance, how easily we can recall them). Our troubles in recalling words with “n” as the second last letter make us think those words don’t occur very often, and we subconsciously ignore the obvious facts in front of us.

Although the availability heuristic is a natural process of our thinking, two Chicago scholars have explained how wrong it can be:

Yet reliable statistical evidence will outperform the availability heuristic every time.

The lesson here? Whenever possible, look at the facts. Examine the data. Don’t base a factual decision on your gut instinct without at least exploring the data objectively first. If we look at the psychology of language in general, we’ll find even more evidence that looking at facts first is necessary.

8. We pay more attention to stereotypes than we think we do.

The funny thing about lots of these thinking mistakes, especially those related to memory, is that they’re so ingrained. I had to think long and hard about why they’re mistakes at all! This one is a good example--it took me a while to understand how illogical this pattern of thinking is.

It’s another one that explains how easily we ignore actual facts:

The human mind is so wedded to stereotypes and so distracted by vivid descriptions that it will seize upon them, even when they defy logic, rather than upon truly relevant facts.

Here’s an example to illustrate the mistake, from researchers Daniel Kahneman and Amos Tversky:

In 1983, Kahneman and Tversky tested how illogical human thinking is by describing the following imaginary person:

Linda is 31 years old, single, outspoken, and very bright. She majored in philosophy. As a student, she was deeply concerned with issues of discrimination and social justice and also participated in antinuclear demonstrations.

The researchers asked people to read this description, and then asked them to answer this question:

Which alternative is more probable?

1. Linda is a bank teller.

2. Linda is a bank teller and is active in the feminist movement.

2. Linda is a bank teller and is active in the feminist movement.

Here’s where it can get a bit tricky to understand (at least, it did for me!)--If answer #2 is true, #1 is also true. This means that #2 cannot be the answer to the question of probability.

Unfortunately, few of us realize this, because we’re so overcome by the more detailed description of #2. Plus, as the earlier quote pointed out, stereotypes are so deeply ingrained in our minds that we subconsciously apply them to others.

Roughly 85% of people chose option #2 as the answer. A simple choice of wordscan change everything.

Again, we see here how irrational and illogical we can be, even when the facts are seemingly obvious.

I love this quote from researcher Daniel Kahneman on the differences between economics and psychology:

I was astonished. My economic colleagues worked in the building next door, but I had not appreciated the profound difference between our intellectual worlds. To a psychologist, it is self-evident that people are neither fully rational nor completely selfish, and that their tastes are anything but stable.

Clearly, it’s normal for us to be irrational and to think illogically, especially when language acts as a limitation to how we think, even though we rarely realize we’re doing it. Still, being aware of the pitfalls we often fall into when making decisions can help us to at least recognize them, if not avoid them.

Have you come across any other interesting mistakes we make in the way we think? Let us know in the comments.

--Belle Beth Cooper is a content crafter at Buffer, a smarter way to share on Twitter and Facebook. Follow her on Twitter at @BelleBethCooper

Reprinted with permission from Buffer

[Image: Flickr user Florian Rathcke]

[Image: Flickr user Florian Rathcke]

Source: http://www.fastcompany.com

No comments:

Post a Comment